IBOS Association (IBOS) today announces the launch of its new and interactive Management Information Systems (MIS) dashboard, for its global network of member banks.

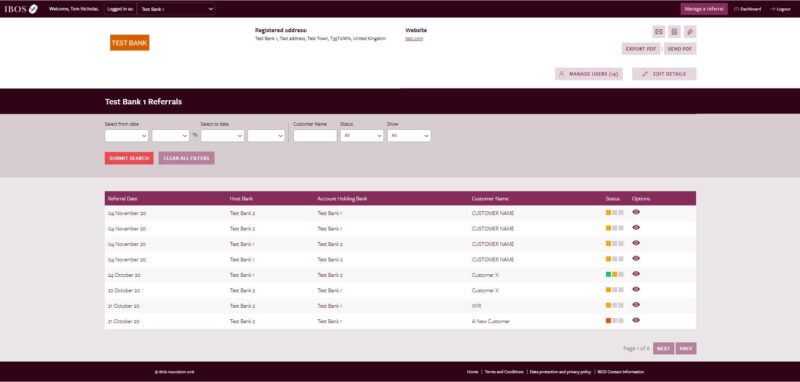

The dashboard will revolutionise the referral process for IBOS’ member banks, enabling streamlined and quick referral processes. Member banks will now be able to drill down into both open and closed referrals, gathering in-depth data, including the status of a referral, and also identify why these are either successful or unsuccessful.

The MIS dashboard provides users with access to new or in-progress referrals, as well as closed referrals at either the completed/rejected or withdrawn stage. To ensure privacy, this can only be accessed by permitted users.

Commenting on the development and launch of the dashboard, Tom Nicholas, Guaranteed Service Level Officer, commented: “We are delighted to be launching our new dashboard. We have given careful consideration to the development of this, to ensure a seamless user experience that is both intuitive yet in-depth and driven by data.

“With the ongoing pandemic currently limiting the scope for businesses to meet face to face, digital innovations, like this dashboard, ensure IBOS and its member banks continue working closely in tandem, across the world, and refer leads to each other within a streamlined, efficient system.”

The MIS dashboard is also available on mobiles and tablets, enabling easy access for executives who are constantly on the go and require referral status information at a glance and within seconds.

Manoj Mistry, Managing Director, added: “This tool highlights IBOS’s digital innovation as our network works towards enhancing the client referral portal, in order to be as effective and efficient as possible for member banks. We are also in the early stages of developing a digital KYC and client onboarding tools for existing members.”

IBOS is a unique international alliance of some of the largest banks in the world. Members collaborate to serve their international clients in markets where they themselves do not operate. IBOS member banks now provide geographic coverage to clients in 75% of the globe, particularly all of Europe, North and South America and the Asia-Pacific region.