Streamlined Account Opening. Seamless Global Access.

IBOS empowers member banks to open accounts for international clients quickly, securely, and without the need for a physical presence.

Through shared governance frameworks, local compliance expertise, and the secure IBOS Member Portal, we simplify cross-border onboarding – reducing friction, accelerating timelines and enhancing client experience across jurisdictions.

Empowering Your Clients Everywhere

As part of the IBOS network, your bank can extend to clients the same breadth of services they enjoy locally, delivered seamlessly across borders.

Our global services include:

Credit facilities tailored to multinational needs

Foreign exchange solutions for efficient international transactions

Deposit and investment services to support liquidity and growth

Local Expertise

IBOS Association brings together leading banks from across the world to deliver international services with precision, speed and compliance. Our member institutions provide deep, on‑the‑ground knowledge of their markets, ensuring multinational clients receive trusted, culturally attuned and fully compliant support wherever they operate.

Through a secure and collaborative Member Portal, shared governance frameworks and a trusted alliance of premier institutions, IBOS simplifies cross‑border onboarding, optimises treasury operations, and empowers banks to serve clients seamlessly across jurisdictions.

By combining global reach with local expertise, IBOS transforms international banking into a collaborative, scalable and client‑centric experience, bridging borders with insight, integrity, and trust.

Effective Solutions

We support member banks in equipping themselves with practical, adaptable solutions that transform the way they serve international clients.

Every solution is designed to address real‑world banking challenges, from regulatory complexity to operational inefficiency, delivered in a way that is both collaborative and client‑centric.

Through IBOS, member banks gain access to:

01

Streamlined account opening that eliminates physical presence requirements and accelerates client onboarding.

02

Treasury optimisation capabilities that support liquidity management and cross‑border operations with precision

03

Shared governance frameworks that ensure consistency, transparency, and trust across the network

04

Digital onboarding tools that reduce friction, enhance efficiency, and improve client experience

Real-Time Balance & Transaction Reporting, Smarter Decisions

Member Banks are able to deliver accurate, timely balance and transaction reporting across jurisdictions, empowering clients with the data they need to manage liquidity, monitor activity, and make informed decisions.

Through secure digital channels and coordinated governance, IBOS ensures reporting is consistent, compliant and tailored to multinational client needs, no matter where accounts are held.

Integrated Features for Global Liquidity and Payments

IBOS Association empowers member banks to offer multinational clients seamless access to local credit cards, payment rails, and cash facilities, without the need for a physical presence.

Through trusted partnerships and coordinated governance, our network supports efficient fund movement, local disbursements and liquidity access across jurisdictions. Whether it’s issuing local cards, enabling domestic payments or providing working capital support, IBOS’ platform ensures its Members Banks clients operate with speed, compliance and confidence, anywhere in the world.

Secure Digital Gateway for Member Collaboration

The IBOS Portal is the Association’s secure, cloud-based platform designed to streamline collaboration, document exchange, and operational coordination among member banks. Migrated to Microsoft Azure in 2025, the portal offers enhanced performance, scalability, and data security.

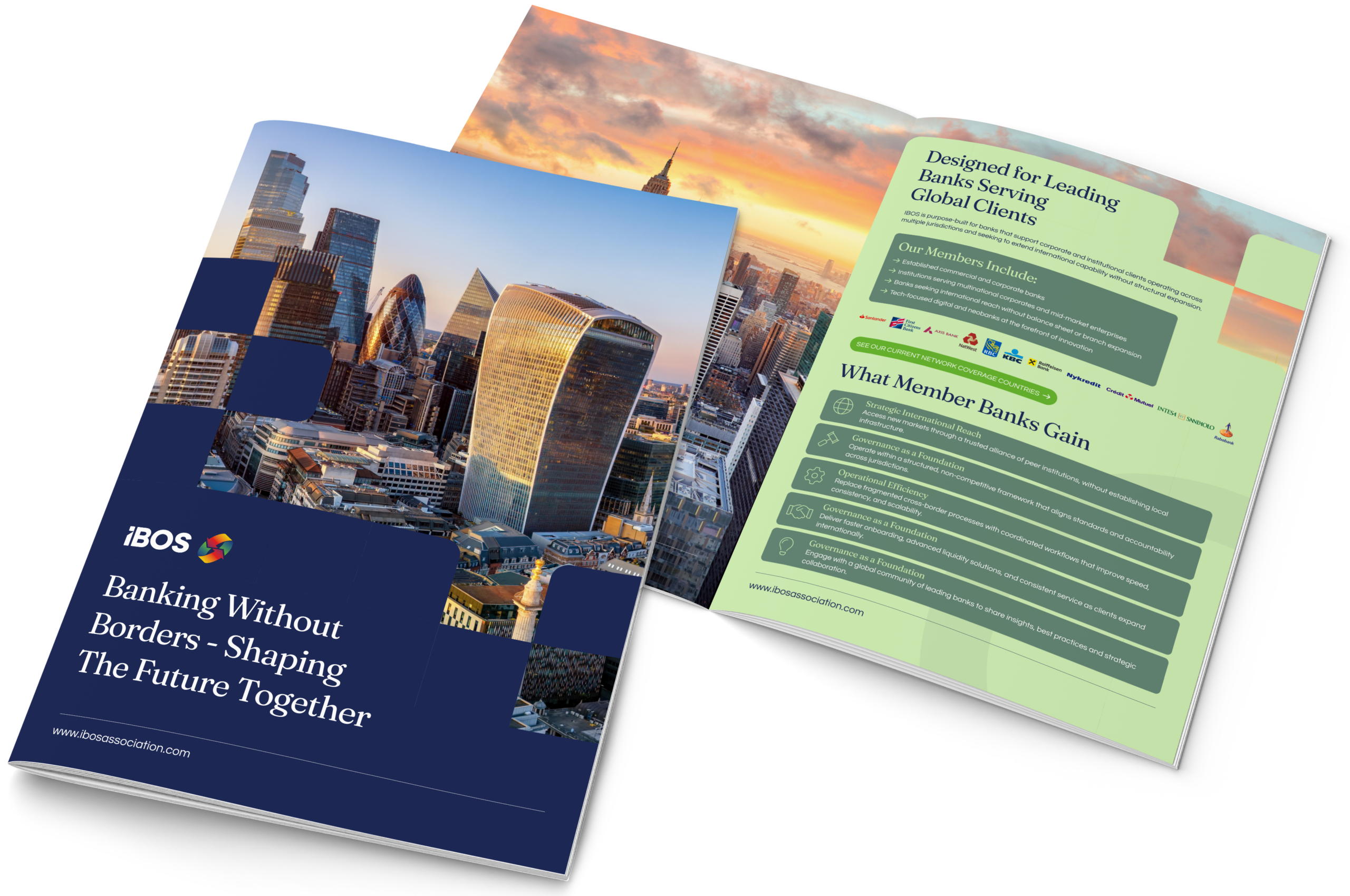

About IBOS

IBOS was established to meet a clear demand from corporate clients who needed dependable, seamless banking support across different countries.

Your Guide to Seamless Account Opening

Discover how IBOS enables member banks to onboard international clients swiftly and compliantly, without requiring a physical presence.

Become a Member. Unlock Seamless Onboarding

Join a trusted alliance of leading banks to streamline cross-border onboarding, expand client reach and operate globally, without the need for physical presence.